Interesting facts

The Rise and Fall of Roman Coinage: Why Did the Roman Coin Become Worthless?

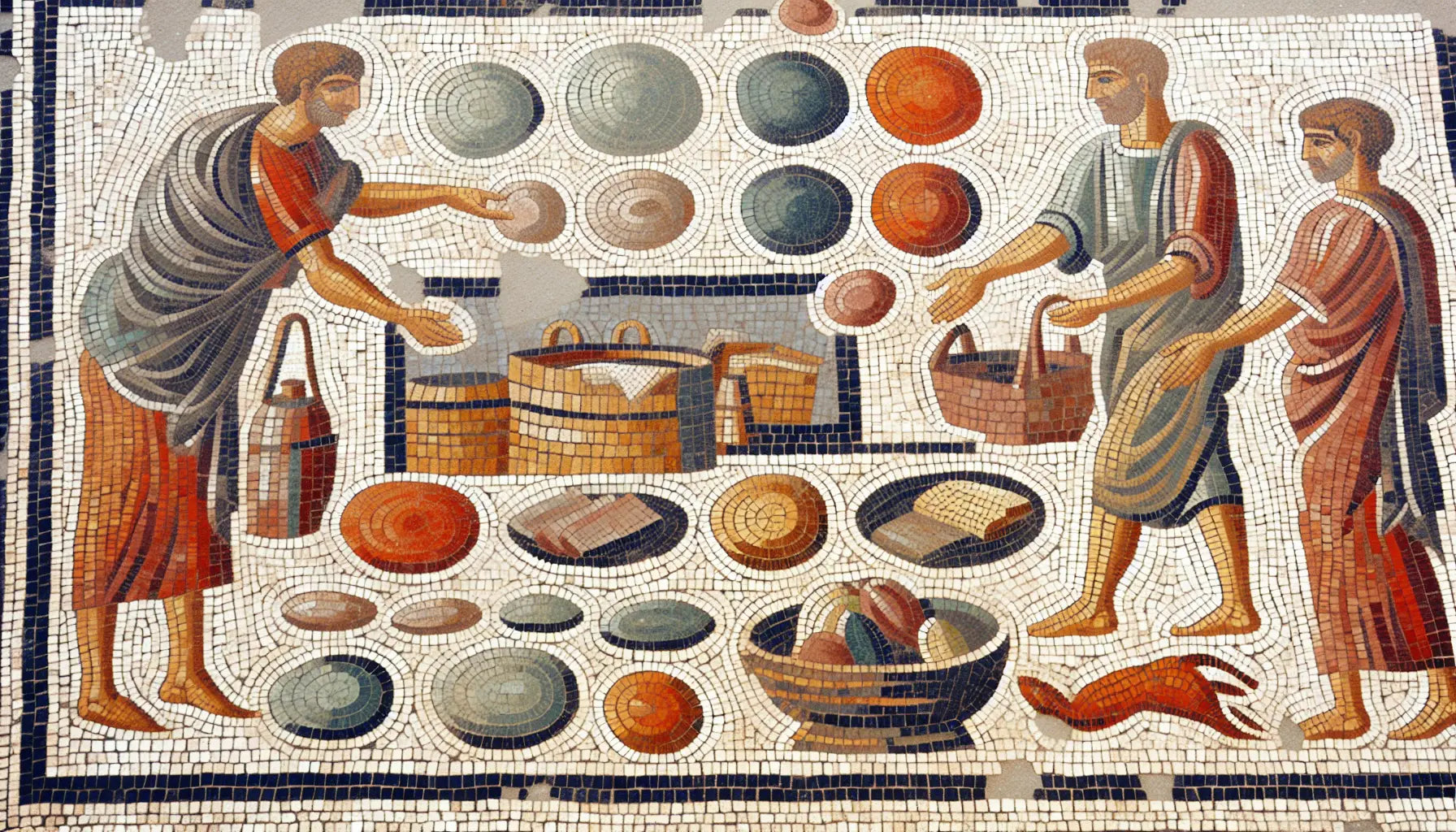

Imagine living in the grand Roman Empire, where bustling markets resonate with the chatter of vendors, grand amphitheaters host thrilling spectacles, and magnificent temples soar towards the sky. At the heart of this complex society was a system of currency—coins that carried not just monetary value but also the prestige and stability of a mighty civilization. These coins were trusted mediums of exchange, essential for daily life, from purchasing food to paying soldiers. Yet, over the course of centuries, this trusted medium—the Roman coin—gradually lost its worth. What caused this downturn? How did coins that once symbolized Rome’s power become nearly worthless? To understand this, we need to embark on a journey through economics, politics, and human behavior woven into the fabric of ancient Rome.

The Foundation of Roman Coinage: Trust Rooted in Metal

The economy of Rome, like that of many ancient civilizations, was tightly linked to metals. Gold, silver, and bronze were far more than ornamental materials; they formed the backbone of Rome’s coinage system. Early Roman coins, such as denarii made from silver and aurei from gold, held intrinsic value because they contained precious metals in nearly pure form. Holding a Roman denarius meant you had a coin with genuine silver content, valuable beyond just its stamped number. This metal-based worth gave people a solid reason to trust the currency as a reliable medium for trade.

But trust in a currency doesn't come solely from its physical metal. Equally important was the belief that the coin would maintain its value over time, fostering confidence among traders, soldiers, and citizens alike. To see vivid examples of such coins, explore the collection at Aurora Antiqua, where history tangibly connects the past to the present.

The Burden of Empire: Why Debasement Began

Roman emperors stood at the helm of a vast empire that required immense spending. They had to pay legions thousands of miles from Rome, protect borders stretching from Britain to the Middle East, build monumental infrastructure like roads and aqueducts, and support the luxurious lifestyles of the ruling elite. Often, the empire’s expenses outpaced its income from taxes and tributes.

Without modern financial tools like central banks or comprehensive tax systems, emperors faced a desperate dilemma: how to fund these vast needs? The solution they adopted was currency debasement—a practice that slowly chipped away at the value of money by reducing the amount of precious metal in each coin while keeping its face value the same.

Debasement meant that instead of minting denarii with nearly pure silver, Rome produced new coins that contained less silver mixed with cheaper metals like copper. On the surface, this seemed clever—the empire could create more coins with the same silver reserves, theoretically expanding the money supply to meet its needs. But in reality, this tactic began a slow unraveling of monetary trust that would have far-reaching effects.

The Slippery Slope: How Over-Minting Undermined Trust

Picture this: you visit the market and buy bread with a silver denarius, confident in its value. A year later, someone hands you a coin with the same name and face value, but it contains much less silver. Naturally, you start to doubt if your money really holds the same worth. This gradual erosion can set off a dangerous economic spiral.

In Rome, as more debased coins flooded the market, people soon noticed their shrinking silver content. Individuals began hoarding older coins made from purer metal, rejecting the newer debased pieces. This behavior reflected what economists now call Gresham’s Law: “bad money drives out good money.” As people clung to valuable coins and used debased ones for transactions, inflation began tightening its grip.

Own a Piece of History

Discover the Diana RingShortage of Precious Metals: The Empire’s Dwindling Resources

Another crucial yet often overlooked factor was the shrinking supply of precious metals. The Roman Empire, though vast, was limited by natural resources. When Rome expanded, it gained access to rich gold and silver mines in conquered lands, fueling a flourishing coinage system. However, by the 3rd century AD, many of these mines were exhausted, became harder to work due to invasions, or fell under unstable control.

Without a steady influx of fresh gold and silver, the empire struggled to back its currency. This scarcity pushed emperors to lean even more heavily on debasement. The supply of precious metal simply couldn’t keep pace with Rome’s growing demands for cash. This shortage deepened the crisis, feeding the vicious cycle of depreciation and inflation.

Inflation in Ancient Rome: A Slow-Motion Crisis

Inflation might seem like a modern malaise, but Rome grappled with it in real terms centuries ago. As coins’ silver content shrank and more low-value coins circulated, prices for everything—from staple grains to luxury silk—rose sharply. Literary sources and economic historians have pieced together records showing how even common goods became increasingly expensive over time. Comprehensive resources, such as those offered by Wikipedia, provide detailed insights.

For ordinary people, inflation was no abstract concept but a daily hardship. Those living off fixed incomes or savings saw their purchasing power evaporate. Soldiers and civil servants, vital to the empire’s functioning, demanded higher wages to cope with rising prices, placing yet more strain on the treasury. Meanwhile, in some regions, coins became so untrustworthy that barter and local trade gained renewed importance, highlighting the fracturing nature of the economy.

Diocletian’s Reforms: A Last Attempt at Stabilization

By the late 3rd century AD, the Roman monetary crisis had escalated to the point of near-collapse. Recognizing this, Emperor Diocletian launched a series of bold reforms designed to stabilize the economy. He introduced new coinage with more reliable metal content, hoping to restore confidence in the currency. Additionally, Diocletian issued the famous Edict on Maximum Prices, attempting to cap prices throughout the empire in an effort to curb inflation. These efforts serve as a testament to the enduring struggle with economic turbulence and can be visually appreciated through crafted coins available on platforms like Numismatics.

Though ambitious, these reforms faced enormous challenges. Enforcement was uneven, with black markets thriving as people sought to circumvent price controls. Coins were still mistrusted, and political divisions limited the reforms’ effectiveness. Ultimately, while Diocletian’s measures slowed the decline, they could not fully restore the former stability of Roman coinage in a fracturing empire.

The Broader Impact: Economic Instability and the Empire’s Decline

The fall in value of Roman coinage was not a mere economic footnote. Instead, it reflected and amplified broader weaknesses in the empire. Monetary instability disrupted trade networks and made military provisioning unreliable. When soldiers and officials stopped trusting their pay, loyalty frayed. The public’s faith in imperial authority waned as economic chaos spread.

What lessons can modern economies learn from the fall of Roman coinage?

The fall of Roman coinage highlights the crucial role of trust in maintaining currency value. Modern economies can learn that monetary stability depends on responsible fiscal policies and trust between the government and its citizens. Debasement or unsustainable financial practices can erode this trust, leading to inflation and economic instability. Therefore, ensuring transparency, maintaining a balance in monetary supply, and safeguarding the resources that back a currency is essential to prevent similar declines.

As trust in currency collapsed, communities reverted to localized economies based more on barter or alternative currencies. The empire’s unity suffered, hastened by political strife and barbarian invasions. Did the coin’s devaluation directly cause Rome’s fall? Probably not by itself, but it certainly worsened the difficulties and weakened the empire’s resilience.

A Lesson from History: The Fragility of Trust in Currency

The story of Rome’s coinage is a reminder that currency’s power depends fundamentally on trust. When governments tamper with the metal content or flood markets with debased coins, confidence erodes. This can trigger inflation, social unrest, and economic fragmentation—problems not unique to the ancient world.

Today, as we face debates about inflation, fiscal responsibility, and monetary policy, the Roman experience echoes loudly. It shows how delicate the balance is between issuing currency and maintaining its value, and how damage to trust can have lasting consequences.

Interestingly, the Roman monetary system included the aureus, a gold coin intended as a symbol of stability and high value. Despite its prestigious status, the aureus eventually suffered the same fate as other coins, showing just how deeply the empire’s economic stresses penetrated.

In Retrospect: Reflecting on the Worth of Roman Coins

Understanding why the Roman coin lost its value takes us beneath the surface of grand history into the nitty-gritty of economics, leadership decisions, and social trust. It reveals how fiscal policy, natural resources, and human psychology interact in sustaining or destroying monetary systems.

While the world marvels at Rome’s architectural wonders and its enduring cultural legacy, the rise and fall of its coinage offers a sobering lesson. No empire, no matter how mighty, can ignore the fragile foundations of its economy. The slow erosion of coin value stands as a warning about short-term fixes, the dangers of losing public trust, and the need for balanced, thoughtful stewardship of financial resources.

Next time you hold a coin—whether ancient or modern—consider the invisible web of trust and history it carries. Each coin is more than metal stamped with numbers; it is a promise, a pact between individuals and their society. Break that promise, and even the greatest empire’s riches may one day turn to dust. The story of Roman coinage endures as a timeless testament to the delicate dance between power, money, and trust.

One fascinating relic from this era is our 'Diana' - Roman Silver Intaglio Ring (1st-3rd BCE/CE), which beautifully captures the spirit and history of ancient Rome. From its design to the stories imbued within, it's a tangible connection to the era when Roman currency held its awe-inspiring power. Discover this piece at Aurora Antiqua.

What makes this ring unique?

Why did Roman coins lose their value?

Roman coins lost value due to currency debasement, increased minting of low-value coins, and a shortage of precious metals. This eroded trust and led to inflation.

How did debasement affect the Roman economy?

Debasement weakened economic stability. It led to inflation, reduced trust in currency, and disrupted trade. People hoarded pure coins and mistrusted new coins, causing economic fragmentation.

What lessons can we learn from the Roman coin devaluation today?

The Roman coin devaluation teaches us that maintaining trust in currency is essential. Modern economies must balance issuing currency with preserving value to avoid inflation and instability.